Explore our portfolio of Investments

Properties that Perform

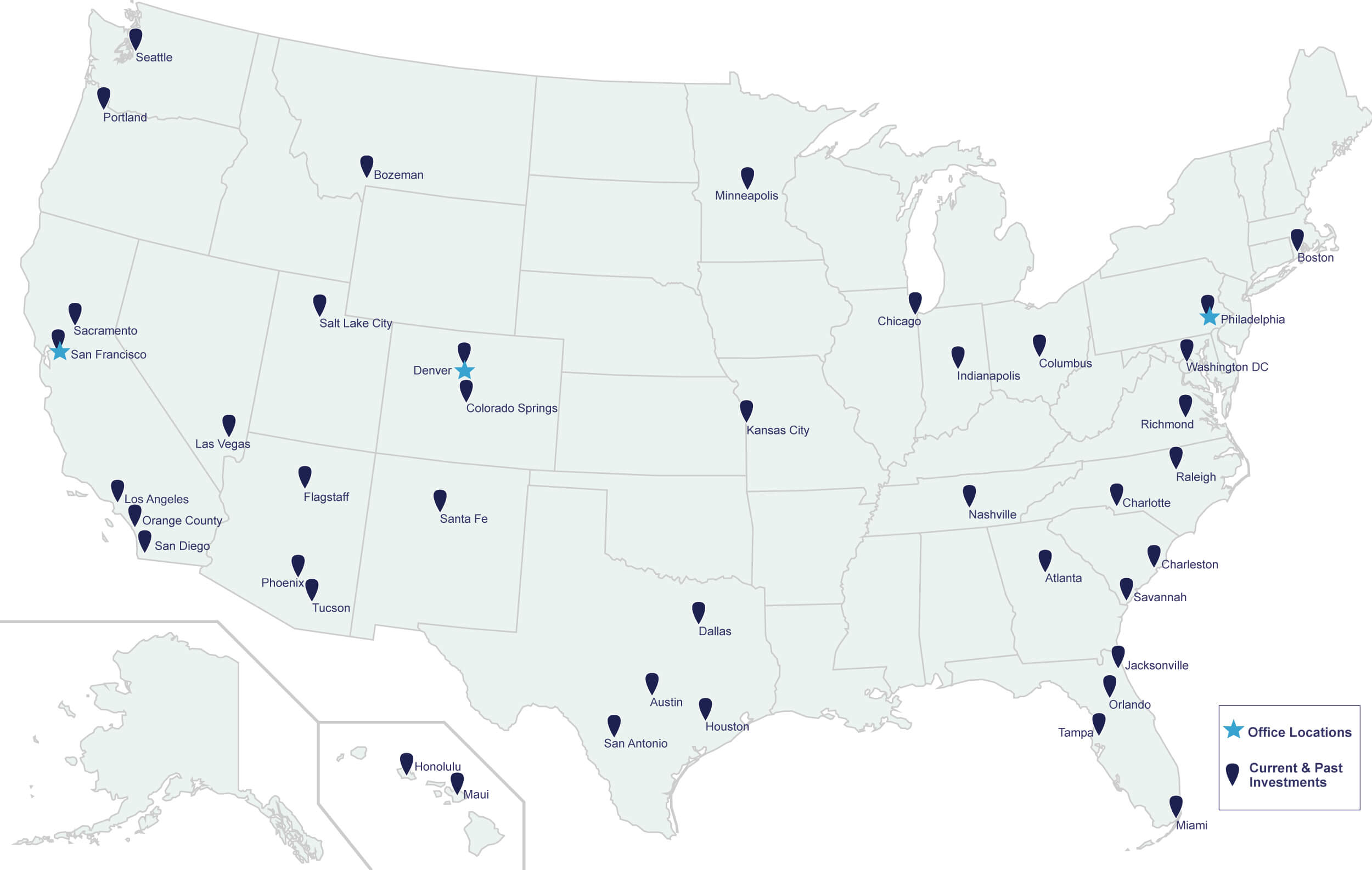

By taking a creative, collaborative approach, we’ve built a nationwide portfolio spanning over 200 completed transactions and currently oversee $3.9 billion in gross real estate assets and uncommitted equity capital under management.

Featured Properties

Acquisition of a 127,000 sf mixed-use retail and office property located in downtown Tempe, AZ

Ground-up development of a 185-unit single-family build-to-rent community in Las Vegas, NV

Acquisition of a 252-unit Class A apartment property located Ladson, a suburb of Charleston, SC

Ground-up development of a 380-unit multifamily community with 23,600 sf of ground-floor retail located in downtown Charleston, SC

Ground-up development of a multifamily community containing 119 build-to-rent townhomes and 89 apartment units located within the Daybreak Master Planned Community in South Jordon, UT

Ground-up development of a 100-unit single-family build-to-rent community in Willow Park, a suburb of Fort Worth, TX

Acquisition of two land sites totaling 265 acres for lot development and sale to homebuilders located in high-growth suburban submarkets of Minneapolis, MN

Acquistion of a 63,700 sf office building and 245-stall parking garage located in the central business district of Austin, TX

Ground-up development of a 129-key extended stay hotel in Aliso Viejo, Orange County, CA

Acquisition and renovation of a 336-unit Class B garden-style apartment community located in the Antioch submarket of Nashville, TN

Acquisition and lease-up of a 64,300 sf infill industrial building located in the Malden submarket of Boston, MA

Acquisition of a 98,800 sf vacant office property for conversion into a life sciences facility

Acquisition of a 75-unit Class A apartment community located in the Midtown submarket of downtown Sacramento, CA

Acquisition of a 96-unit Class A multifamily community located in Tewksbury, a suburb of Boston, MA

Acquisition of an eight-story, 92,100 sf boutique office building with ground-floor retail located in the Wynwood submarket of Miami, FL

Acquisition of an eight-story, 58,600 sf boutique office building with ground-floor retail located in the Wynwood submarket of Miami, FL

Acquisition of a 122,900 sf grocery-anchored shopping center located within the Lakewood Ranch master planned community near Sarasota, FL

Ground-up development of a 157-unit single-family build-to-rent townhome community located in the Poplar Grove submarket of Salt Lake City, UT

Ground-up development of a 109-unit single-family build-to-rent townhome community located in Charlotte, NC

Ground-up development of a 188,600 sf, Class A industrial building located in the Gastonia submarket of Charlotte, NC

Ground-up development of a Curio by Hilton hotel in Scottsdale, AZ

Ground-up development of a 108-unit multifamily community with 2,500 sf of ground-floor retail located in the Edgehill neighborhood of downtown Nashville, TN

Ground-up development of a 226-unit multifamily community located in downtown Las Vegas, NV

A nationwide

portfolio of investments

The investments discussed in this section do not represent an entire investment portfolio and, in the aggregate, may only represent a small percentage of a portfolio’s investments. Each investment discussed has been selected solely to illustrate Argosy’s investment approach and has not been selected on the basis of performance or any performance-related criteria. As such, the objective, consistently applied, nonperformance-based criteria is not intended to represent (or be an indicator of) how the portfolio has or may perform in the future.